Certain non-citizens who are not lawfully present. If you and all members of your tax household are not required to file a state income tax return you do not need to apply for an exemption.

Form 1095 A 1095 B 1095 C And Instructions

For this exemption coverage is considered unaffordable if you would have had to pay more than 805 percent of your household income for the annual premium amount for health coverage in 2015 or.

Health coverage exemption types. The fee is sometimes called the Shared Responsibility Payment or mandate If youre 30 or older and want a Catastrophic health plan see details about exemptions and catastrophic coverage. Form 8965 is used to claim a coverage exemption either granted by the Marketplace also called the Exchange or a coverage exemption for which you are eligible. Under Ghanas NHIS exemption policy widows may be exempted or covered for health insurance through the Livelihood Empowerment Against Poverty Program LEAP a pro-poor social intervention policy.

When the entire family does not have coverage for the entire year each family member with coverage or an exemption needs to be entered in the Detail of individual health care coverage or exemption statement in Screen Coverage in the Health Care folder. You must claim the exemption using the Divisions NJ Insurance Mandate Coverage Exemption Application. Form 8962 is also used to calculate your shared responsibility payment if you did not have health insurance coverage or qualify for a coverage exemption for any specific month during the tax year.

You may be exempt from the individual mandate if your income is below the state tax filing threshold. If you dont have coverage you dont need an exemption to avoid the penalty. See Types of Coverage Exemptions below.

Coverage considered unaffordable The minimum amount you would have paid for premiums is more than 813 of your household income. If youre 30 or older and want a Catastrophic health plan you must apply for a hardship exemption to qualify. If you are claiming a coverage exemption the right-hand column of the chart shows which code you should enter in Part III columns a through m to claim that particular coverage exemption.

You also dont need to file Form 8965 if you. However if you arent required to file a tax return but choose to file anyway you can check the Full-year health care coverage or exempt box on Form 1040. ü B Citizens living abroad and certain noncitizens You were.

The general categories are. IRS Form 8965 Health Coverage Exemptions is the form you file to claim an exemption to waive the penalty for not having minimum health insurance coverage. If you have coverage through your employer buy insurance through a Marketplace or use private insurance you do not need to file tax Form 8965.

Use Form FTB 3853 to determine if you owe an individual shared responsibility penalty or to claim exemptions from the state individual health coverage mandate on your California state tax return. These exemptions concern membership in a federally-recognized tribe or access to services of an Indian Health Services Provider. There are 2 types of exemptions.

Certain citizens living abroadresidents of another state or US. They need to take to request one. There are two types of unaffordable coverage exemptions from the Health Care.

IRS exemptions that you can get from the IRS when you file your tax return. Exemptions You Can Apply for Through Covered California. Enter each different exemption or coverage on a new row for each individual.

The calculation to determine if this exemption applies is on the Health Care. For tax years prior to 2019 those without insurance will receive a penalty when they file their tax returns - that is unless they have an exemption. How to Claim a Short Gap in Coverage.

A health care sharing ministry. You can claim your exemption for a short gap in health coverage on your. The Types of Coverage Exemptions chart on page 3 shows the types of coverage exemptions available and whether the coverage exemption may be granted by the Marketplace or claimed on your tax return.

Since January 1 2019 the requirement to maintain health insurance coverage its corresponding penalty and exemptions from the mandate have remained in statute but the penalty for. See details about exemptions and catastrophic coverage. If you live in Maryland visit Maryland Health Connection for information on exemptions.

Uninsured for less than 3 consecutive months. Health coverage exemptions forms how to apply. If the health coverage available to you last year would have been unaffordable you may qualify for an exemption.

Get a letter from your health plan that says how long you. Short Coverage Gap Exemption Code B Exemption Code B. If you qualify for Federal COBRA or Cal-COBRA you cannot be denied coverage because of a medical condition.

Qualify for this exemption. The first exemption is for health insurance premiums that are more than eight percent of household income. Short coverage gap of 3 consecutive months or less.

Exemption must be applied to the first gap in coverage. Marketplace exemptions that youll need to request by completing a paper application and mailing it to the Health Insurance Marketplace. If you dont have coverage after 2019 you dont need an exemption to avoid the penalty.

Exemptions are available for reasons such as earning income below a certain level experiencing a short gap in coverage having no affordable coverage options or enduring a hardship. ü A Short coverage gap You went without coverage for less than 3 consecutive months during the year. If the coverage gap is 3 months or longer none of the months in the gap qualify for the exemption.

See the instructions under Part II later to see if your. The Affordable Care Act or Obamacare is an individual mandate that requires all eligible Americans to have some form of basic health coverage. Health coverage is considered unaffordable exceeded 824 of household income for the 2020 taxable year Families self-only coverage combined cost is unaffordable.

Minimum essential coverage which includes most types of public and private health insurance coverage though some individuals were exempt from the mandate. You dont have to file Form 8965. For example if you lack coverage from March 2 until August 15 you do not qualify for an exemption for any of those months.

Use the California FranchiseTax Board forms finder to view Form FTB 3853. The LEAP program can be reformed to ensure better targeting and inclusion of vulnerable groups. What Kind of Coverage Is Considered Unaffordable.

These laws also allow your spouse former spouse or child to keep health insurance after your job ends after divorce or your death. If you qualify for an exemption you can report it. You can only apply for a Covered California exemption for tax years 2020 and later.

Health Insurance Antitrust Exemption Eliminated Jones Day

Understanding The Different Types Of Health Insurance Plans Alliance Health

Self Employed Health Insurance Deduction Healthinsurance Org

Section 80d Deduction Deduction For Medical Insurance Health Checkup

Californians Without Health Insurance Will Pay A Penalty Or Not California Healthline

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

2022 Aca Open Enrollment Guide

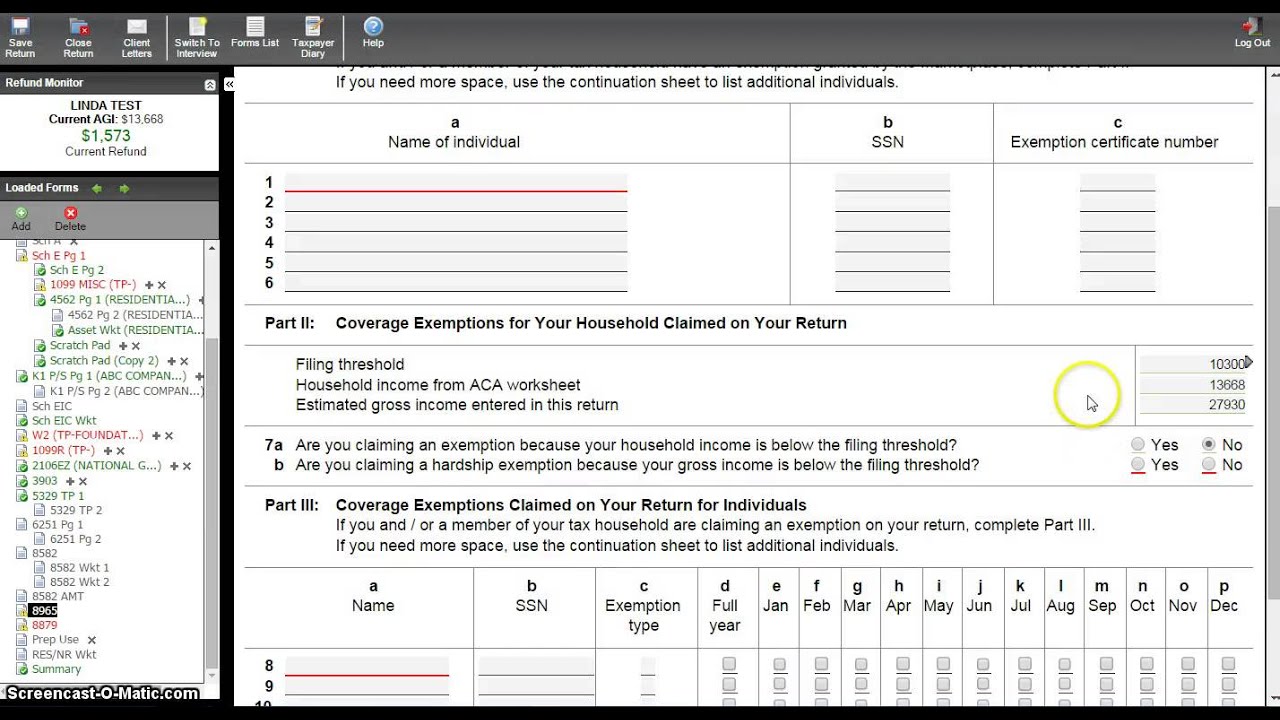

Form 8965 Health Coverage Exemptions And Instructions

4 New Hardship Exemptions Let Consumers Avoid Aca Penalty For Not Having Health Insurancekaiser Health News

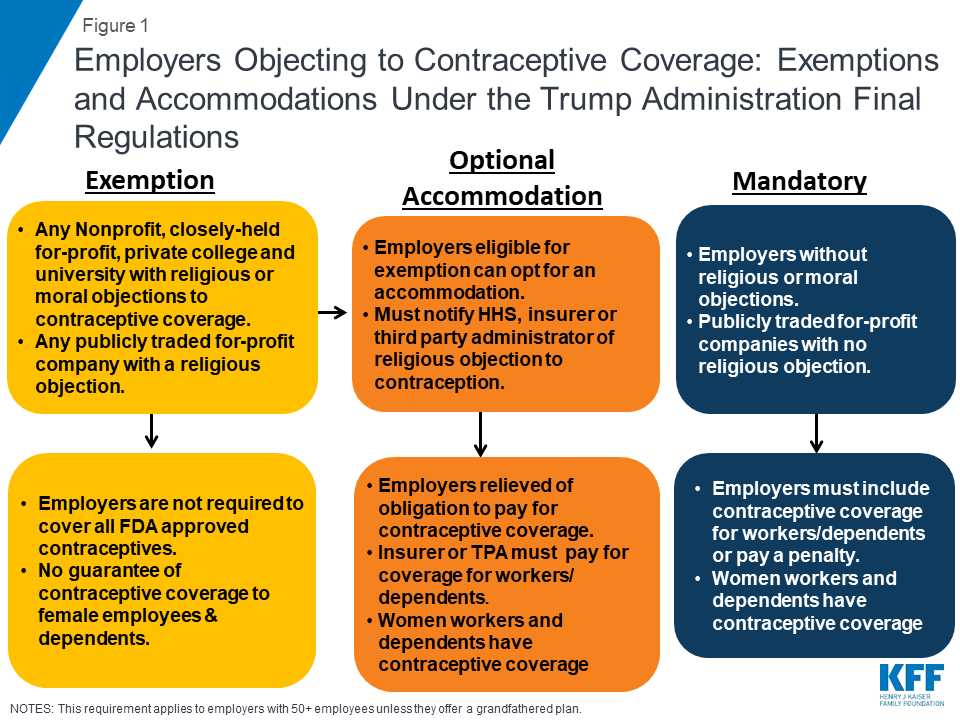

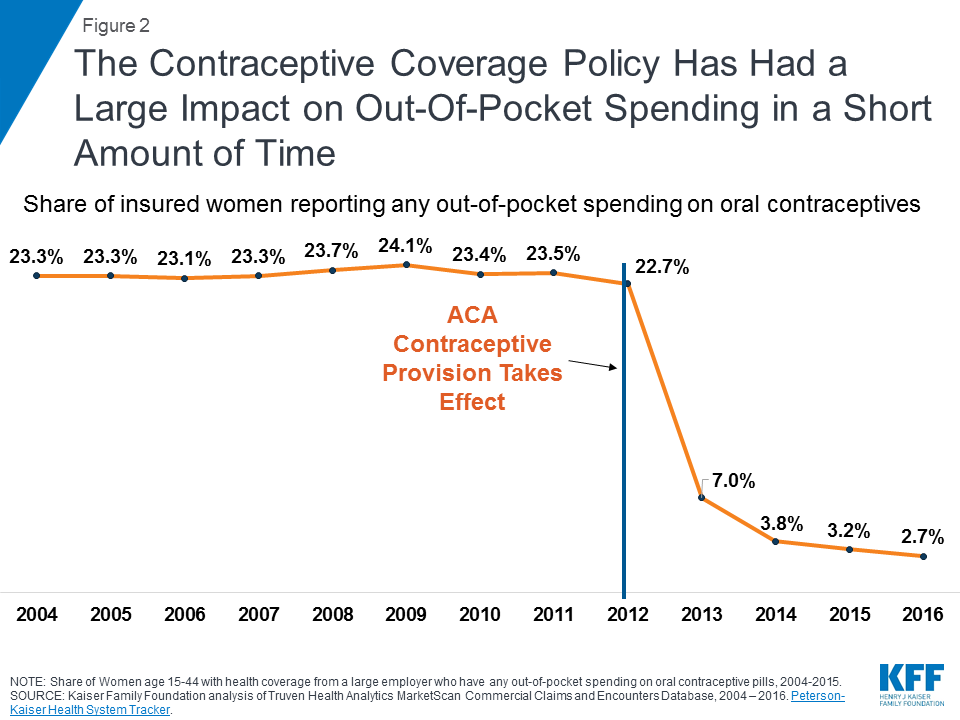

New Regulations Broadening Employer Exemptions To Contraceptive Coverage Impact On Women Kff

Update On Indonesian Visa And Stay Permit During Covid 19 Pandemic

Workers Comp Exemption Workers Compensation Exemption

Form 8965 Health Coverage Exemptions And Instructions

New Regulations Broadening Employer Exemptions To Contraceptive Coverage Impact On Women Kff

Pdf Waivers And Exemptions For Health Services In Developing Country