Automobile Insurance Eligibility Michigan law requires every vehicle owner to purchase automobile insurance and guarantees that automobile insurance will be available to all eligible Michigan citizens. Thats 71 less than the average.

Why Auto Insurance In Detroit So Damn High Explained

Whether you live in Detroit Dearborn Livonia Canton Westland or somewhere else in Wayne County Insurox offers choices for car insurance that could help you save hundreds of dollars a year.

Michigan car insurance detroit mi. Keep reading to learn more. Compare local agents and online companies to get the best least expensive auto insurance. Donegal has the highest average rate for full coverage car insurance in Detroit.

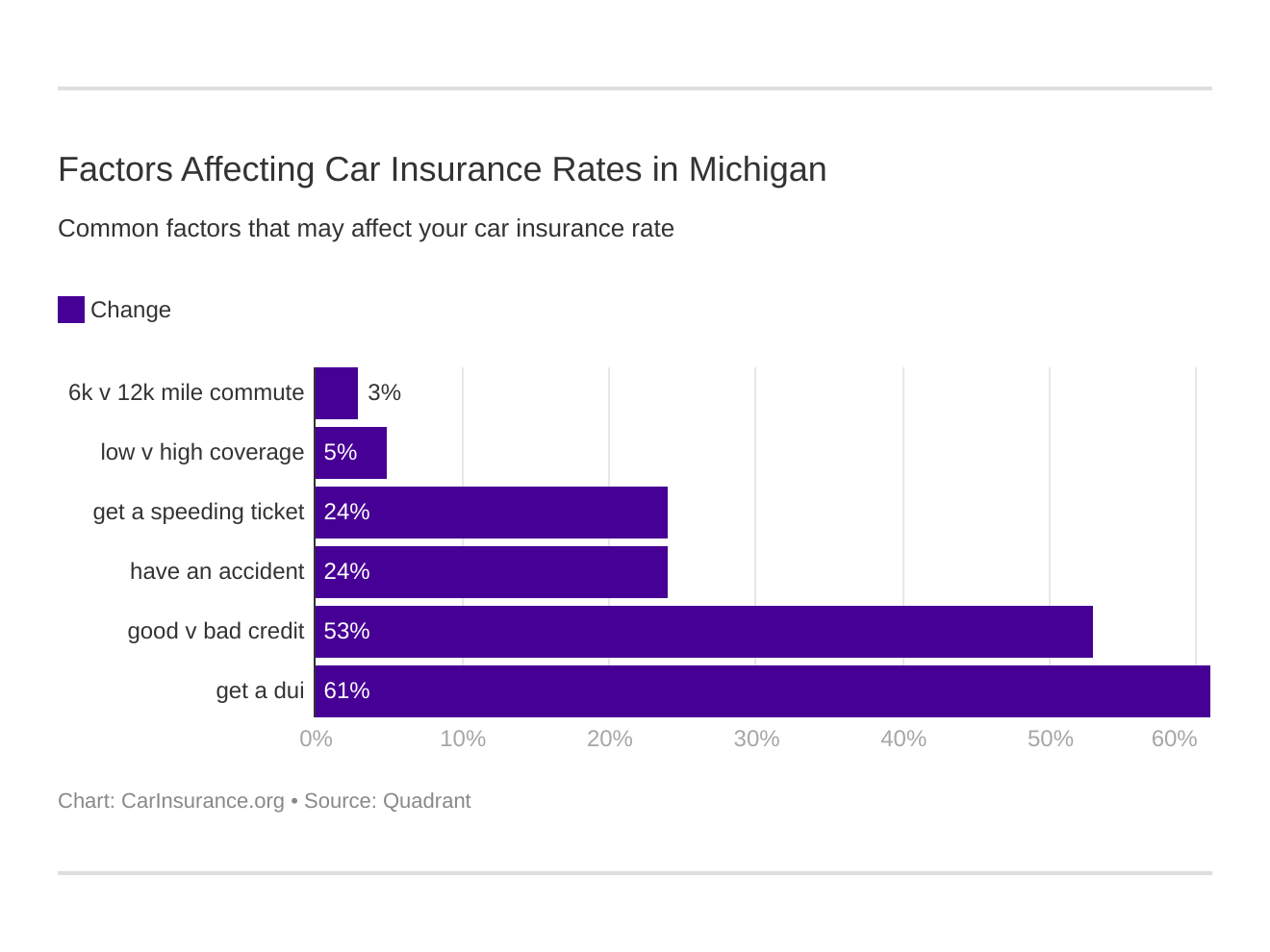

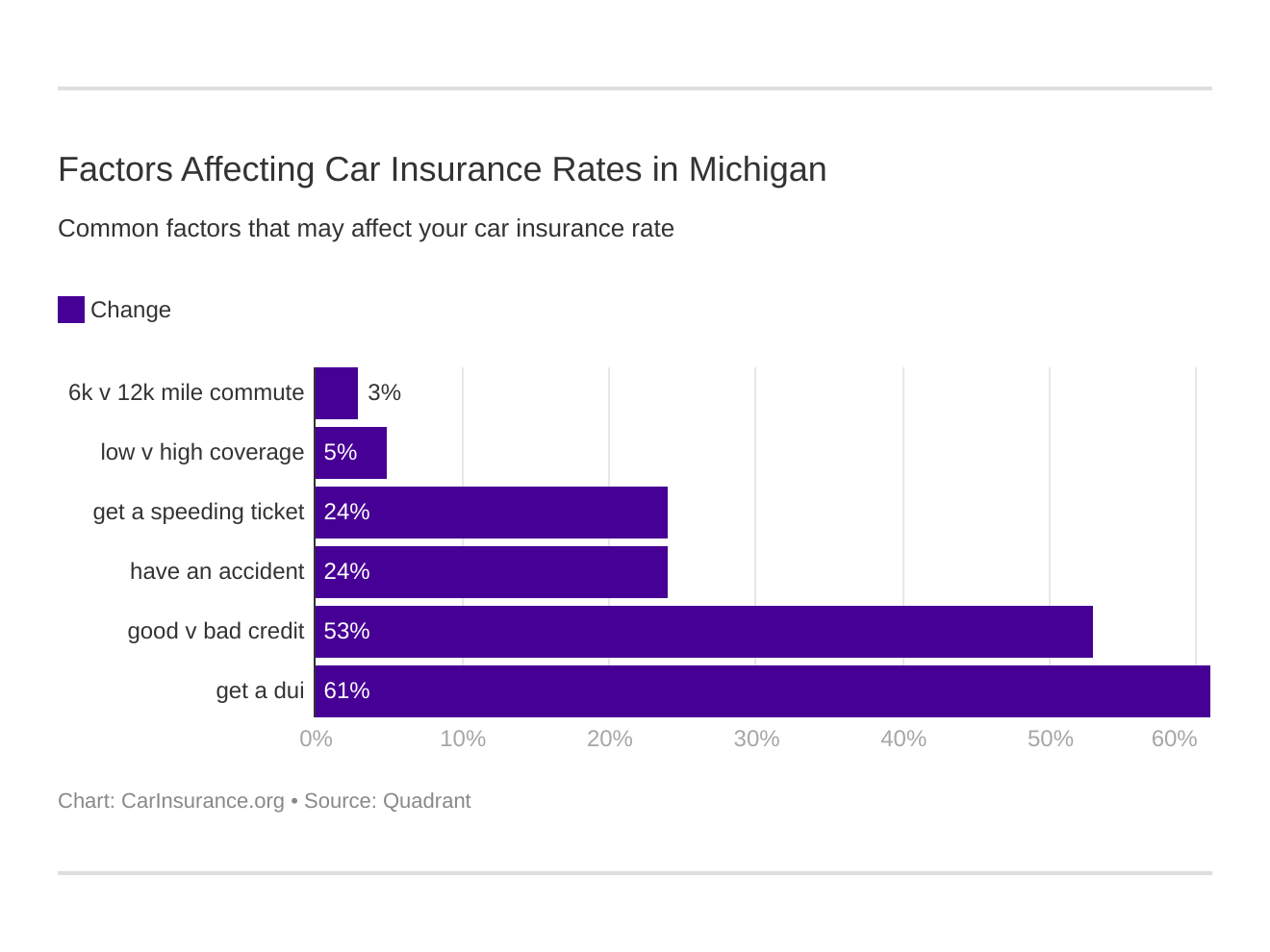

Helps cover expenses related to the injury or death of another driver or a pedestrian when an accident is your fault. Nationwide offers a range of car insurance discounts that can help lower your monthly premium you may be eligible for these exclusive discounts below. Drivers with great driving records typically enjoy cheaper car insurance rates than drivers with histories of speeding tickets at-fault accidents or DUI citations.

Thats more than the average in Michigan 3096 and more expensive than the national average of 1548. Why Auto Insurance is Expensive in Detroit. Thats because we understand that everyone has individual needs when it comes to their MI auto insurance.

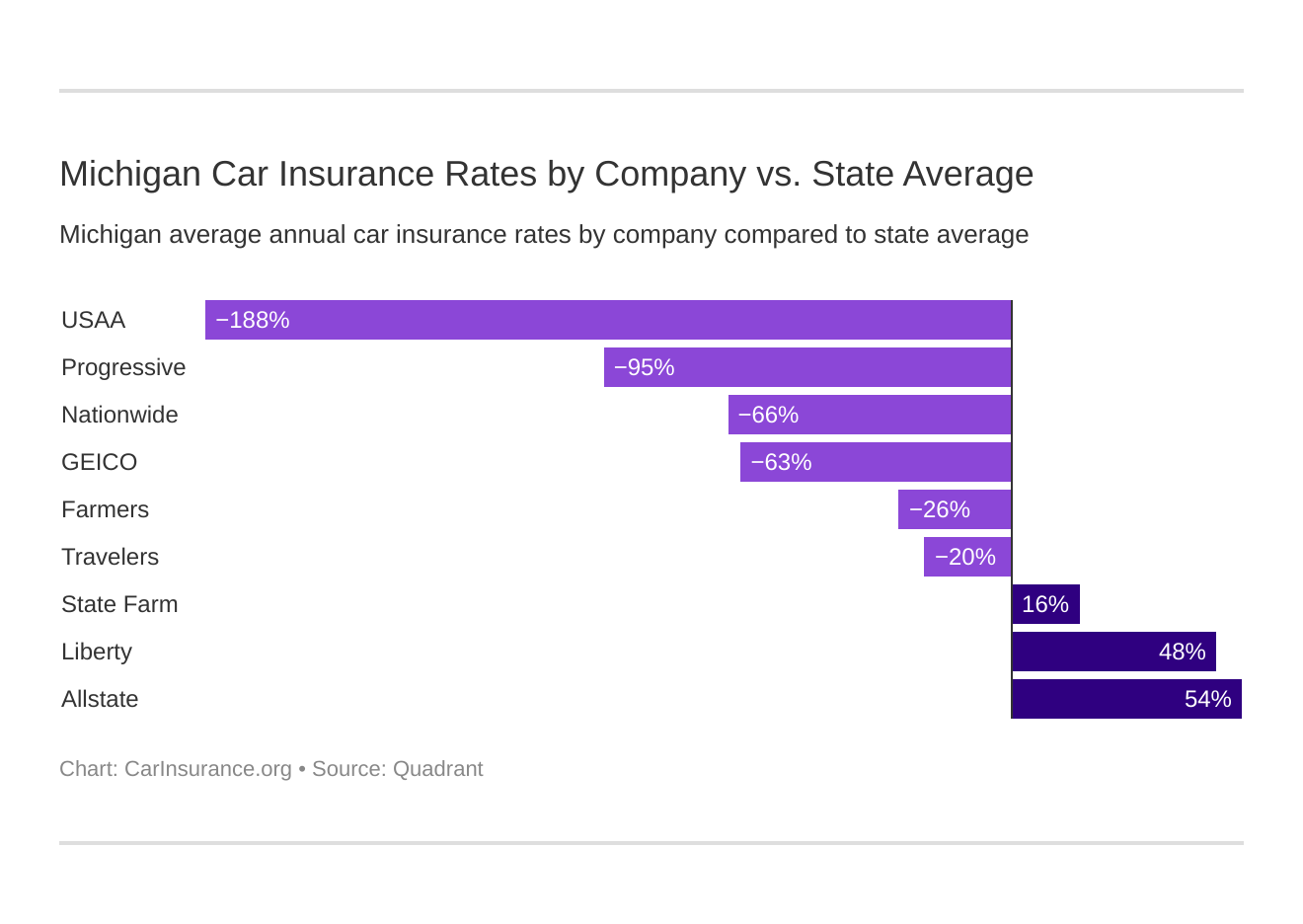

The primary reason for high rates is Michigans no-fault laws. AP All insured Michigan drivers will be getting refunds due to a 5 billion surplus in a fund that reimburses insurers medical and other costs for people seriously injured in. However Progressive offered our sample driver a much more affordable rate of 3794.

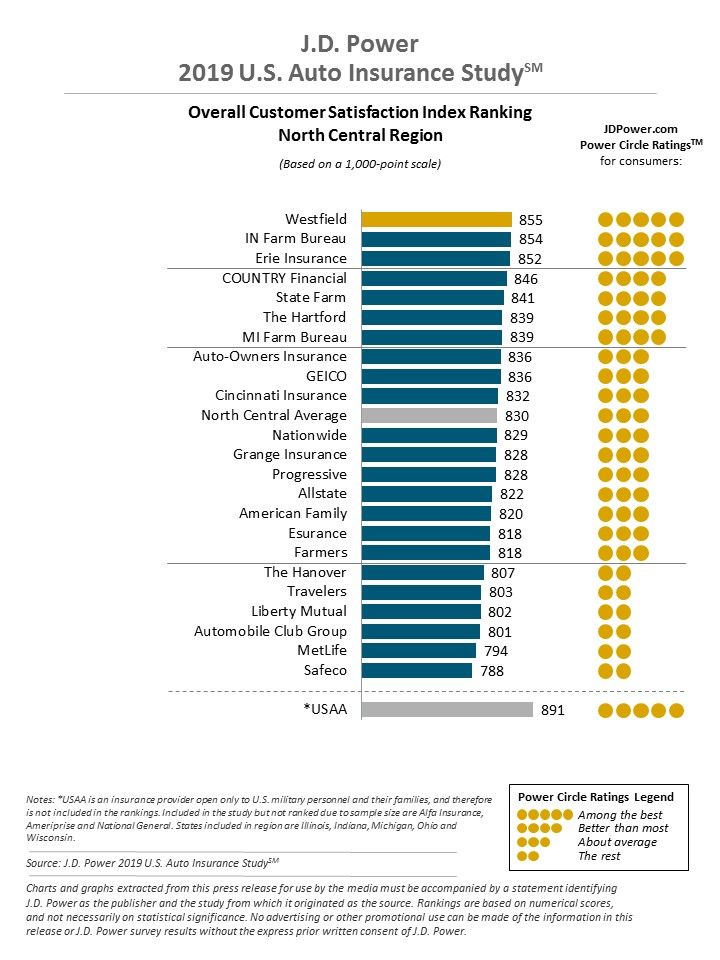

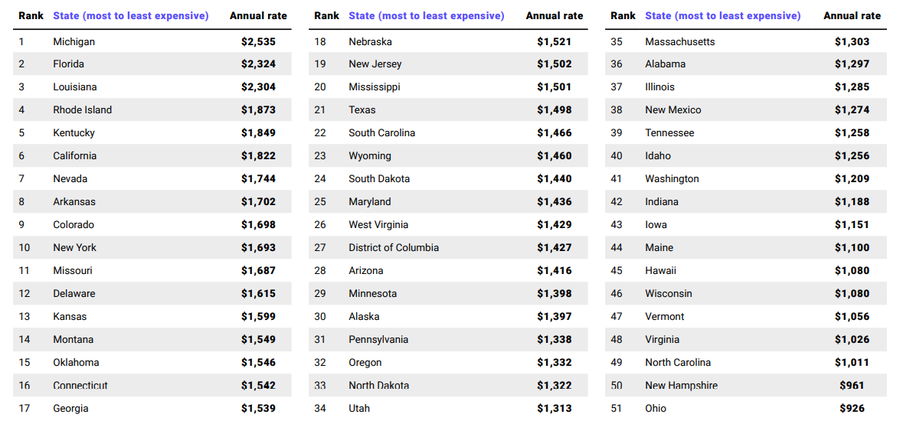

USAA has the lowest average car insurance rate in Detroit at 1831 per year. Our guide to Detroit car insurance includes average rates based on age credit score driving history and marital status. In 2018 Michigan ranked second highest for most expensive auto insurance with average expenditures of 146973 per year.

Detroit Car Insurance Requirements. Michigan ranked second highest for uninsured drivers in 2019 with an estimated 255 without insurance coverage. Cheap auto insurance for good drivers in Michigan.

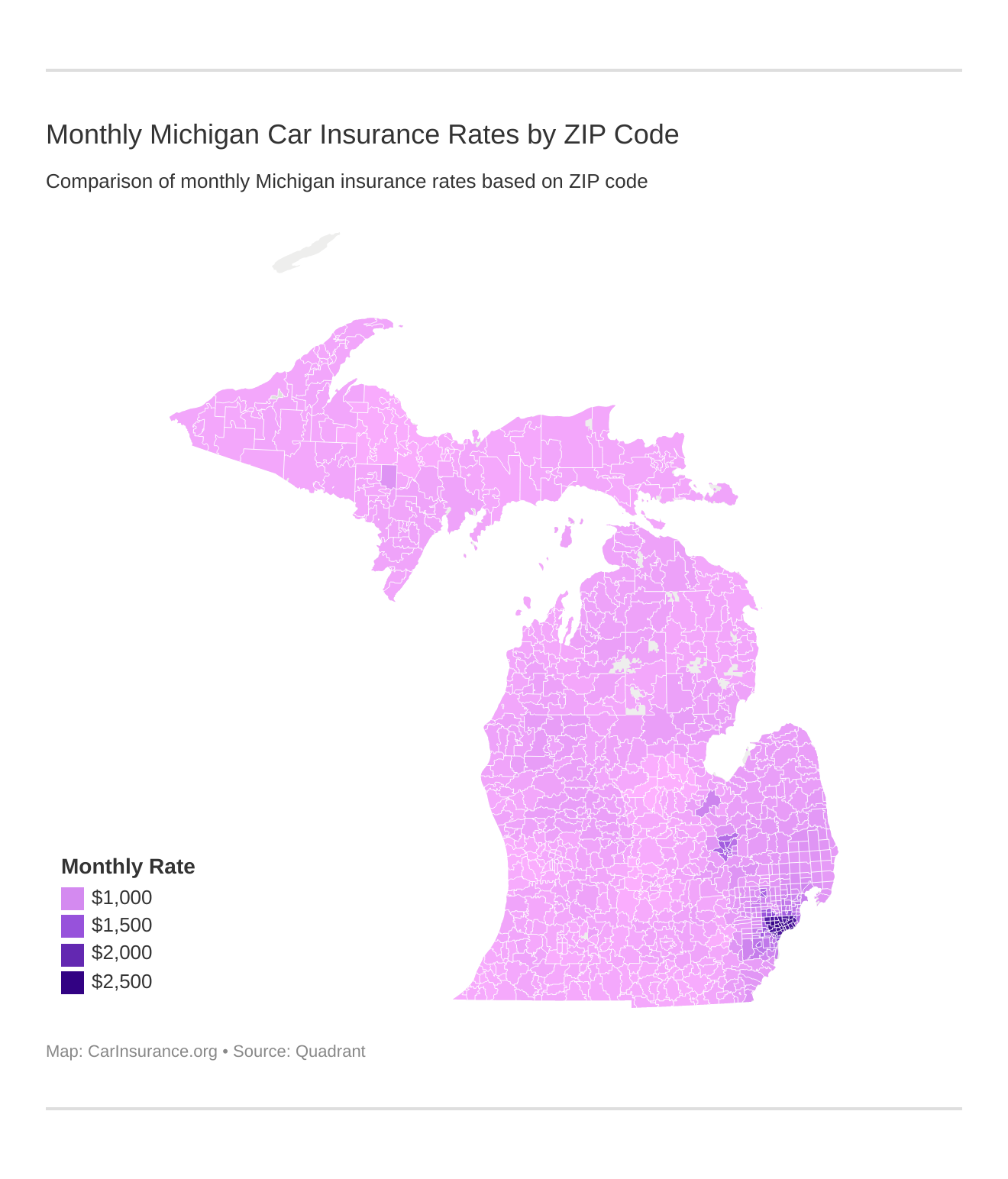

Rates can vary from city to city. Eligible citizens means for automobile insurance a person who is an owner or registrant of a car registered or to be registered in Michigan or a valid Michigan drivers. Auto Insurance - DIFS Auto Insurance.

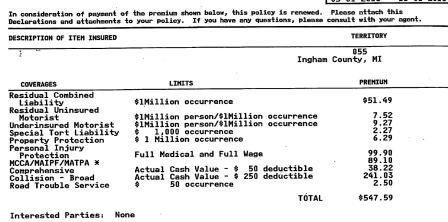

In Detroit and throughout Michigan drivers of any motor vehicle must own an auto insurance policy to legally operate their car truck motorcycle or scooter. Michigan law requires every vehicle owner to purchase automobile insurance and guarantees that automobile insurance will be available to all eligible Michigan citizens. The residents of Detroit typically pay 26620 per month while people who live in Flint will pay 17460 per month on average.

Governor Whitmer signed historic bipartisan auto no-fault legislation to lower costs for Michigan drivers maintain the highest coverage options in the country and strengthen consumer protectionsThe legislation creates a better no-fault system for drivers. While paying for auto insurance may seem expensive if you have never been in an accident having auto insurance can save you time and money. The typical Detroit driver pays 6280 per year for auto insurance.

Cheapest car insurance in Detroit after an accident. For cheap car insurance in Detroit small crossovers like the Honda CR-V Mazda CX-3 Mazda CX-5 and Hyundai Kona have the most affordable rates. Insurance companies are required to pay all medical expenses as long as its needed including up to three years of lost wages.

An eligible person for automobile insurance is a person who is an owner or registrant of a car r egistered or to be registered in. After a crash we found that rates in Detroit go up by an average of 56 to an average of 13274 for a one-year full coverage policy. Auto insurance quotes in Detroit can vary significantly but drivers with clean driving records have the best rates while.

Whitmer pushes refunds for drivers from 5B in auto insurance fund The fee once surpassed 200 before dropping over two. Michigan minimum liability requirements are 50000 per person and 100000 per accident in bodily injury liability and 10000 in property damage liability. How Much is Car Insurance in Detroit MI.

With uninsured motorist coverage youre protected if the other. 100000 bodily injury liability limit per accident 1. See what people pay for car insurance in other cities in Michigan.

20000 limit per person40000 limit per accident until July 1 2020 Beginning July 2 2020. Compare Detroit MI Car Insurance quotes from multiple companies in minutes. Comprehensive list of 64 local auto insurance agents and brokers in Detroit Michigan representing Foremost Misc State Farm and more.

Why spending 15 or even 7 ½ minutes online and receive only one quote and. 50000 bodily injury liability limit per person 1. If you already have a car insurance policy you know that its very expensive to insure a car in Detroit.

Auto liability insurance is a type of car insurance coverage thats required by law in Michigan so Detroit drivers must have it. Michigan drivers without a recent at-fault accident typically save 57 on their car insurance premiums 7 more than the national average. Nerd Wallet named Liberty Mutual one of the best car insurance companies in 2020 5.

About the new auto insurance law. More specifically the following liability coverages are the minimum required in Detroit. Some might want the cheapest Michigan car insurance while others want more coverage and an auto insurance company they know they can trust.

50000 limit per person100000 limit. Learn ways to get cheaper car insurance. Average car insurance cost in Detroit is 5852 per year which is 2842 more than the national average rate of 1523.

Michigan car insurance discounts. Find out which discounts can be applied to your policy by applying online for a quote or speaking with your local agent. 21 rows Would you like to know who has the best car insurance quotes in Detroit in 2019 how to find.

The Best And Cheapest Car Insurance Rates In Michigan Valuepenguin

Michigan Car Insurance Review Cheap Rates Best Companies

Detroit Isn T The Only City With Outsized Auto Insurance Rates Bridge Michigan

Best Cheap Car Insurance In Detroit Michigan Valuepenguin

Michigan Car Insurance Rates Companies Carinsurance Org

Michigan Car Insurance Rates Decline By 18 But Are Still The Highest In The Country Wdet

Michigan Car Insurance Rates Companies Carinsurance Org

Best Homeowners Insurance Companies In Michigan

Cost Of No Fault Insurance In Michigan No Fault Reform

Michigan No Fault Insurance Law Overview Michigan Auto Law

Cheap Auto Insurance Quotes In Detroit Mi November 2021 Insurify

Best Cheap Car Insurance In Detroit Michigan Valuepenguin

Michigan No Fault Insurance Lawyer Miller Tischler Farmington Hills Detroit

Lying About Living In Detroit To Save On Car Insurance

Michigan No Fault Insurance Law Overview Michigan Auto Law

The Faults In No Fault How Lawsuits Medical Bills Help Drive Up Detroit S Auto Insurance Costs

Michigan Car Insurance Rates Companies Carinsurance Org

Look Insurance Local Agent For Car Insurance In Detroit South West Mi

How Michigan S Auto Insurance Premiums Became The Nation S Highest Bridge Michigan