The average auto insurance in Ontario is over 1500 a year. You dont have to be a BCAA Member but Members save up to 20 on BCAA Optional Car Insurance.

What Is The Total Cost Of Ownership For A Car Ratehub Ca

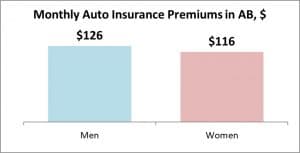

It is fact that ICBC insurance rates for male drivers are relatively higher than female drivers the same age.

How much is car insurance in bc monthly. Despite an almost entirely government-run insurance market BC. Rates are set to decline in May 2021 with the introduction of no-fault insurance. Insurance companies can also predict the likelihood your car will be written off as a total loss.

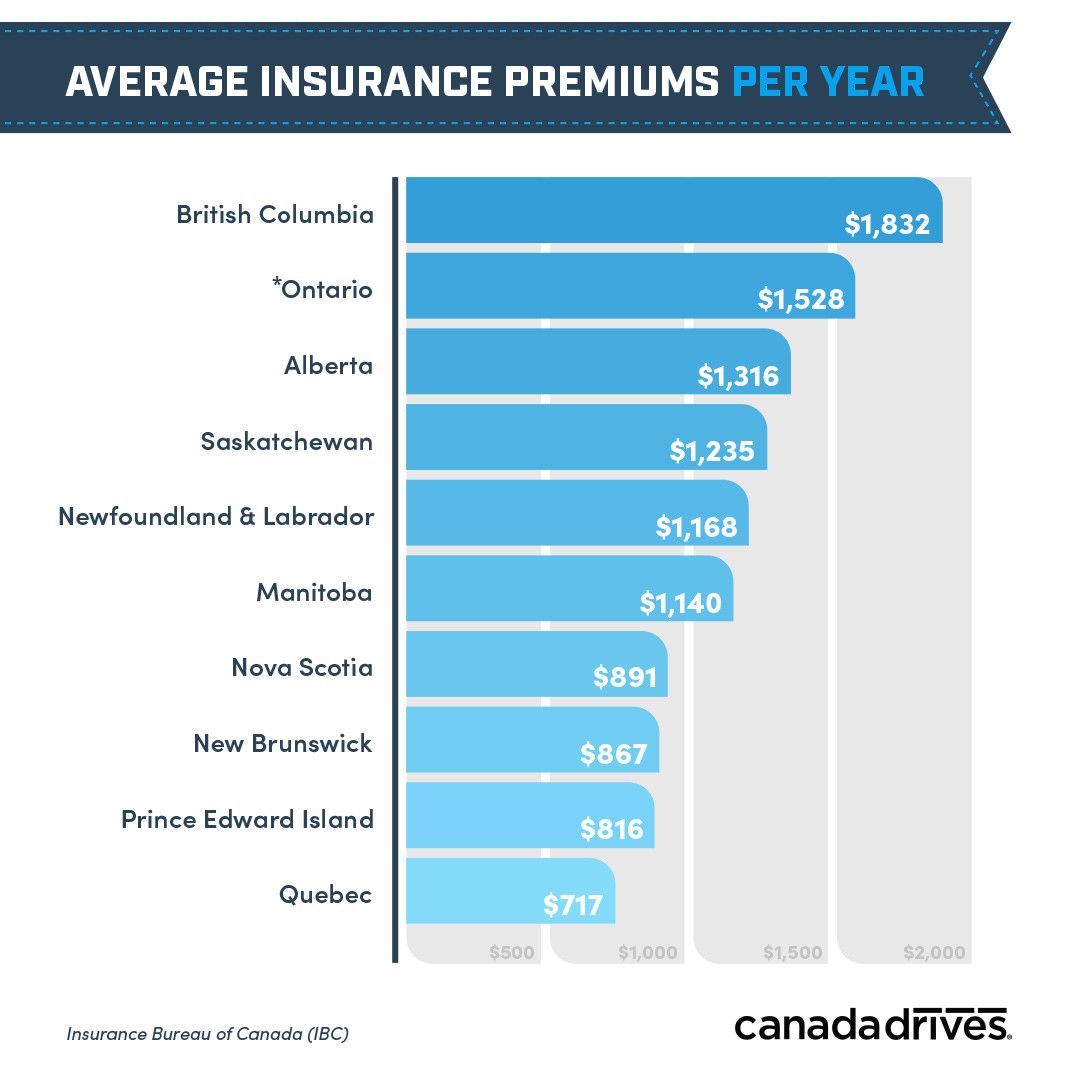

Driving up and down the 401 doesnt come cheap. According to a new report from the Insurance Bureau of Canada IBC British Columbia drivers pay 1832 on average for their insurance coverage annually. More care and coverage after a crash.

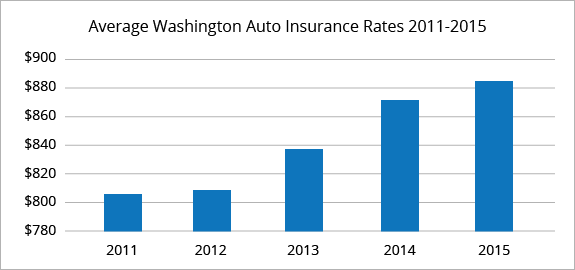

Paying monthly adds administrative costs to your insurer so if youre able to pay in full annually you can lower your premiums. Discover discounts and savings. In 2015 Ontario was the most expensive with average premiums of 1281 per year but its 247 hike doesnt seem too bad in comparison to BC.

This includes third-party liability as well as accident benefits and uninsured motorist protection. Calculate your Autoplan payments. Pay premiums annually instead of monthly.

The base premium either rises or falls depending on your driving and insurance history. Depending on which province you live in you might find that youre paying more for car insurance. You can purchase a full coverage policy to insure your car that costs 147 a month or 1758 per year on average.

British Columbia 1680 average annual premium. Prepare an estimate of your insurance. The average annual car insurance premium in British Columbia is 1680 nearly 14 higher than the next name on the list Ontario 1445.

The average monthly cost of car insurance in BC. The costs of car insurance vary tremendously from province to province depending on the cost and frequency of claims insurance regulations and other factors. We examined the average cost of car insurance by state to help drivers estimate how much they should be paying for coverage.

Average Commercial Vehicle Insurance Rates. Commercial car insurance cost. Understand claims and insurance costs.

After collecting quotes from top insurers across the country we found the average auto insurance rate to be 1623 per year or 135 per month. We take the confusion out of considering all the factors that determine the types and amount of car insurance you need and figuring how much it will cost. Commercial truck insurance cost.

It is cheap to insure trucks and vans than cars. Contact ARC insurance today to get your car insurance quote. But Quebec residents only pay an average of 717 a 1115 price difference.

However you should know that while there may be a minimum amount of car insurance quote in which car owners are entitled to pay based. Youll pay an average of 1832 per year for car insurance in BC according to a report from the Insurance Bureau of Canada. Maintain a good driving record.

We specialize in both private and ICBC auto insurance and will work with you to ensure you have options when it comes to your optional auto insurance. Check with ICBC to make sureyou get a. Commercial tractor trailer insurance cost.

From mandatory ICBC Autoplan to BCAA Optional Car Insurance we have you covered. Insurance companies can gauge how much it will cost to repair a car based on its make and model. The average price of car insurance per month is 65- 200 depending on the auto insurance premium you are signing for.

Commercial taxi insurance cost. Learn More About Our Auto Insurance Calculators. If youre a member of a large corporation union or a school alumnus it could help you get cheaper British Columbia car insurance.

We will also ensure you are aware of exactly whats covered and for how much given the various BC car insurance. Compare quotes from at least three different insurance companies before you renew your plan. You can get insurance coverage for vans with the lowest average cost of 1515 per year.

Monthly insurance rate Base car price. On average drivers will save 20 or about 400 on their full ICBC car insurance annual premiums. The most expensive insurance rates in Canada.

Keep reading to find out more about how car insurance works in BC and learn how you can lock in the best rates. Mandatory third-party liability coverage protects an insured British Columbia driver andor car owner in the event that someone is killed injured or suffers property damage as a result of the drivers negligence. BC runs a break-even profit system although operational costs often outdo revenues.

All British Columbians will have access. While more information will unfold in the months to come heres what to know now about how the changes will impact British Columbians. Placed third and fourth on the list are Alberta 1251 and Newfoundland Labrador 1132 while Manitoba rounds out the top five with an annual average premium of 1080.

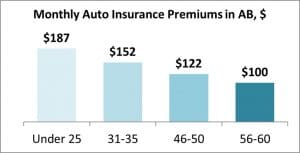

Young male drivers can expect to pay at least 3000 per year for a. Our calculators and tools give you the information you need to make the right choices about your car insurance coverage. Drivers can buy more coverage to suit their needs including.

Medical benefits are limited to 150000 per person in British Columbia. The average cost of car insurance in BC is 1832 or about 150 per month. Because insurance companies consider that male driver much more likely to take more risks than female drivers.

Insurance rates are expected to increase in the coming years. At InsureBC we can help you save money on your car insurance. Looking for an insurance broker in Edmonton.

The base premium for basic insurance is 1063. When its time to renew your car insurance give BCAA a call or if you prefer visit one of our 29 locations across BC. Commercial bus insurance cost.

More affordable insurance rates. Average cost of car insurance in BC. We can shop around for you to make sure you receive the lowest car insurance rate in BC.

Drivers pay the highest car insurance rates in the country. For example in 2015 Newfoundland and Labrador had a total claims cost of 852 per vehicle much higher than Nova Scotia 631 or Prince Edward Island 519. The first part of the calculation process asks for basic information about your vehicle.

Average Car Insurance Payment Life Insurance Blog

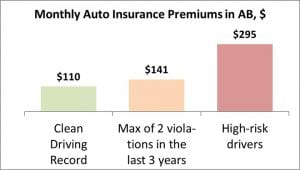

Alberta Car Insurance Costs Canadians On Average 122 Month

Alberta Car Insurance Costs Canadians On Average 122 Month

Homeowner Insurance In Bc By Home Value 2016 Statista

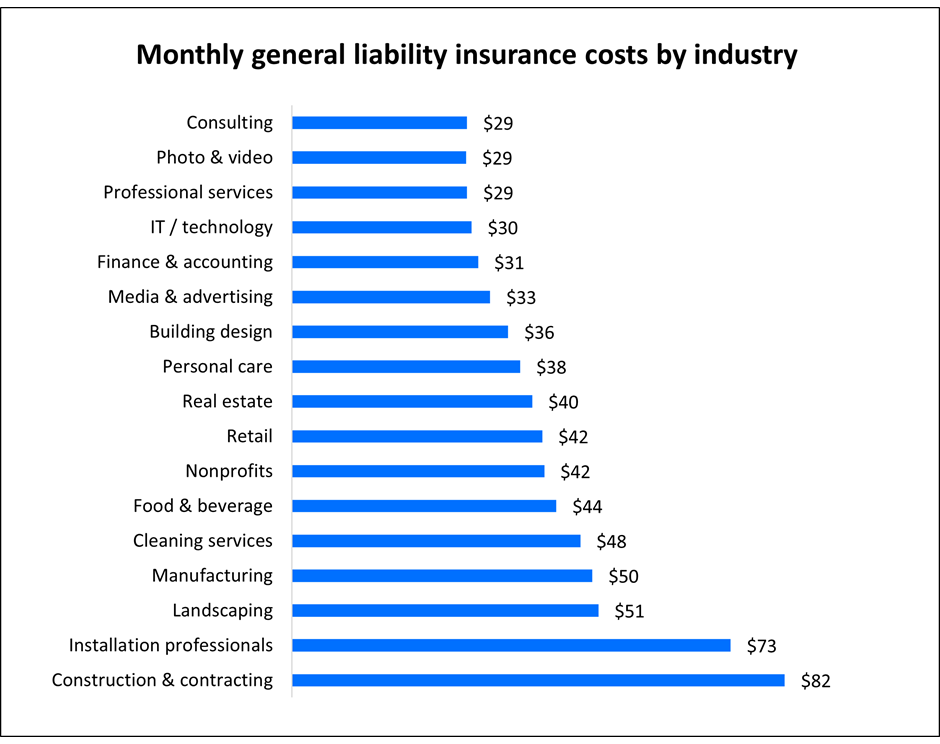

General Liability Insurance Cost Insureon

13 Ways To Get Cheap Car Insurance

Average Monthly Car Insurance Rates In Alberta Brokerlink

Report Men Pay More For Car Insurance Than Women Across All Age Groups Lowestrates Ca

Auto Insurance In Nova Scotia Rates Quotes Expert Tips

Are Average Car Insurance Rates Affected By Age

Average Home Insurance Cost In Ontario Insurance For Home Read This Before You Choose Your Home I Home Insurance Quotes Home Insurance Homeowners Insurance

Alberta Car Insurance Costs Canadians On Average 122 Month

Alberta Car Insurance Costs Canadians On Average 122 Month

Average Car Insurance Payment Life Insurance Blog

Best Car Insurance Rates In Vancouver Wa Quotewizard

Bc Drivers Continue To Pay The Highest Auto Insurance Premiums In Canada

Compare Alberta Car Insurance Quotes Get The Best Rate Ratesdotca

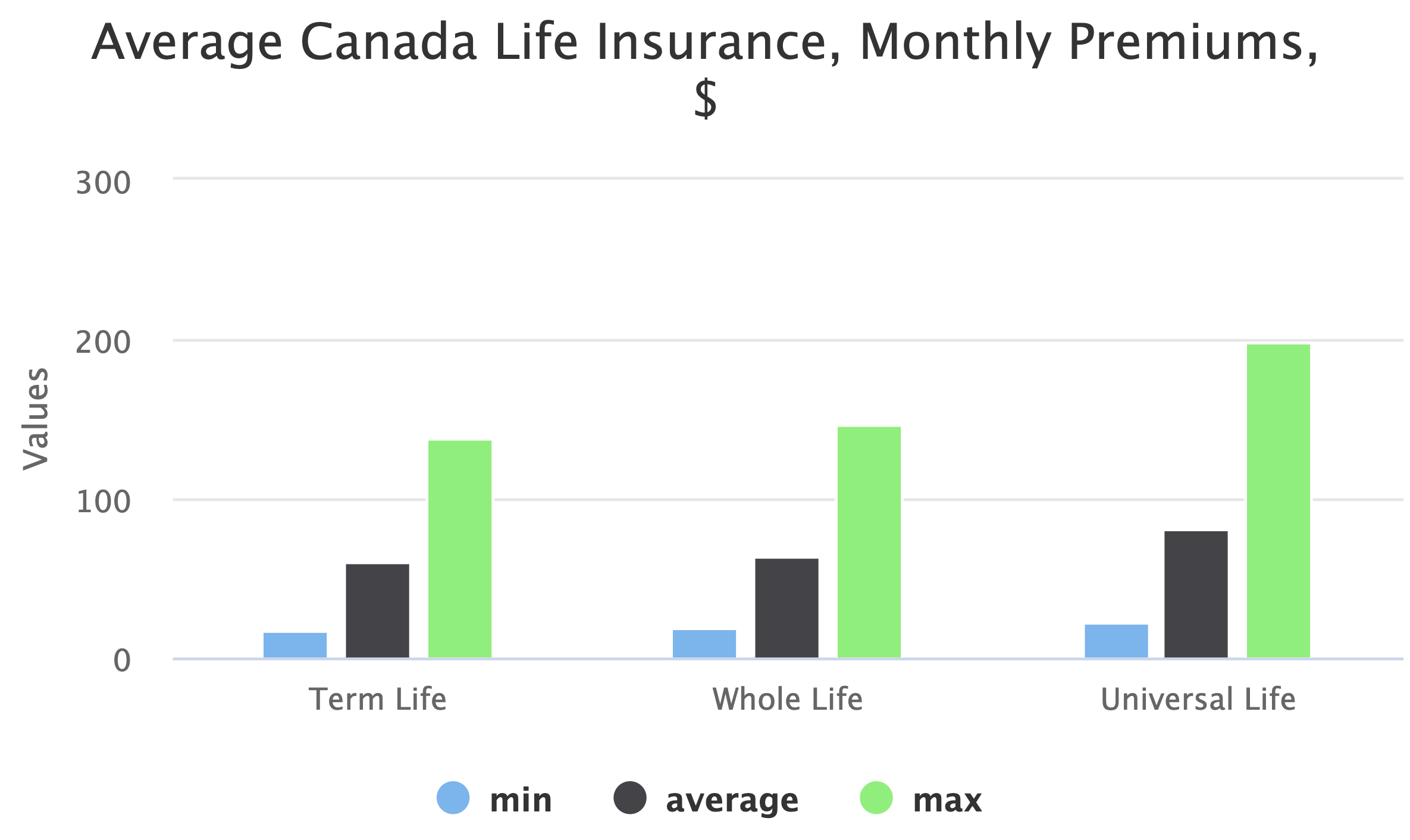

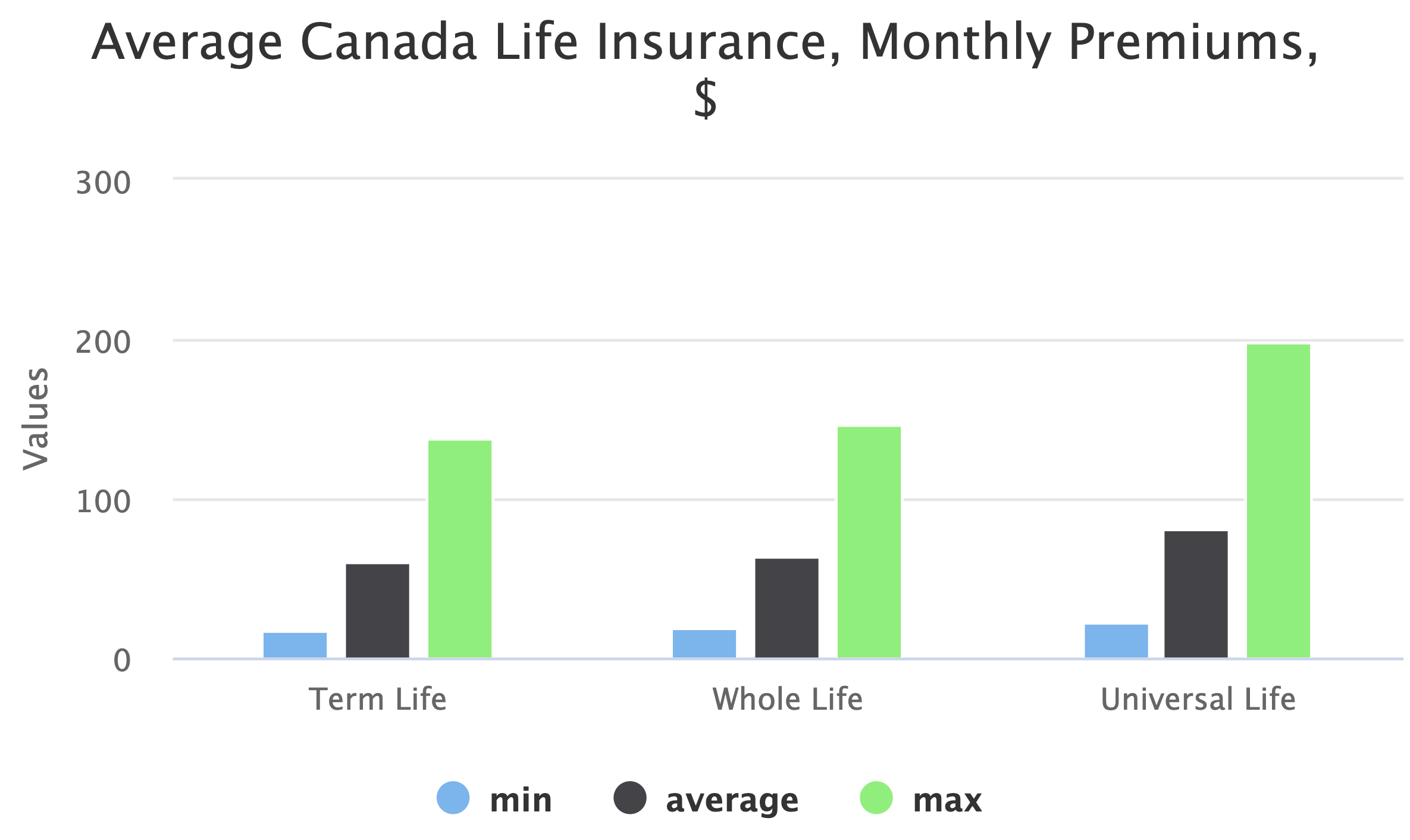

Life Insurance In Bc Best Rates From 25 Insurers

Here S How Much Car Insurance Costs In Your Province Ratesdotca